Why I’m Researching Occidental Petroleum Despite Its Struggles

On the road to financial independence and FIRE (Financial Independence, Retire Early), every step comes with choices. Some of them are obvious—like saving more than you spend, cutting unnecessary costs, or steadily investing in broad index funds. But not every decision is so straightforward. Along the way, I’ve found myself researching opportunities that don’t necessarily fit the “standard FIRE playbook,” but could offer unique upside if approached carefully.

This blog post is one of those moments. Instead of only sharing the usual updates about my savings rate or portfolio growth, I’m diving into a stock that caught my attention: Occidental Petroleum. It’s not a typical choice, but FIRE is a journey shaped by both discipline and exploration—and sometimes it means looking twice at the opportunities that others overlook.

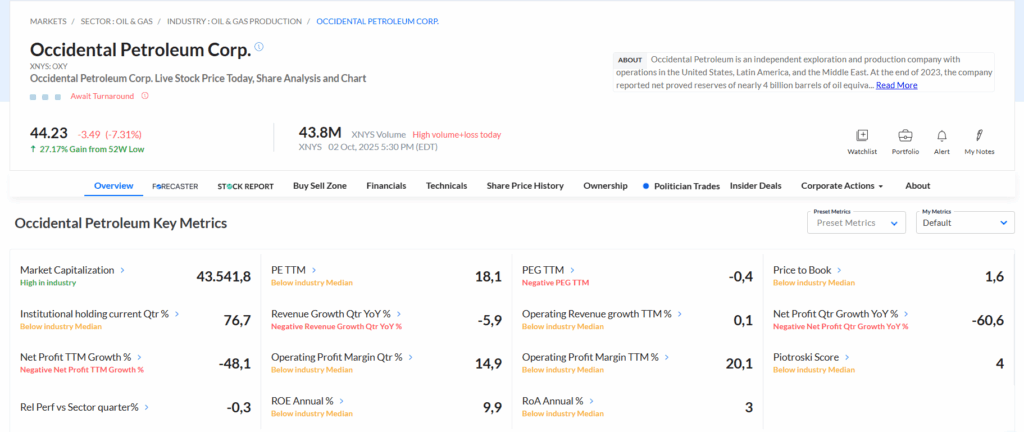

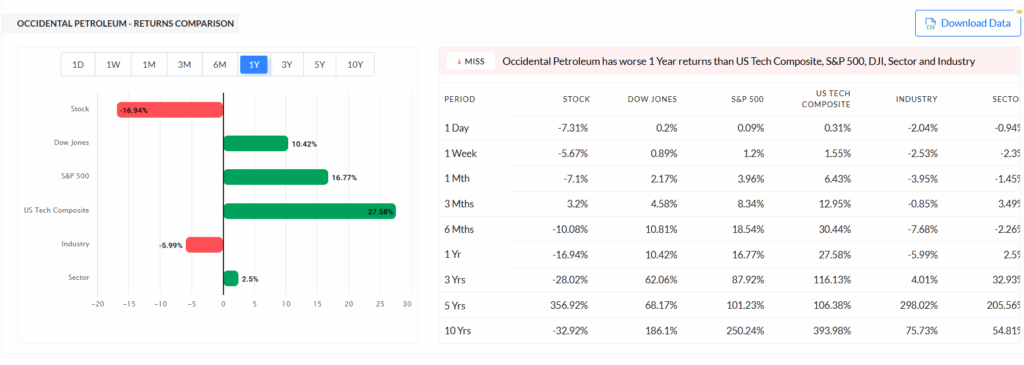

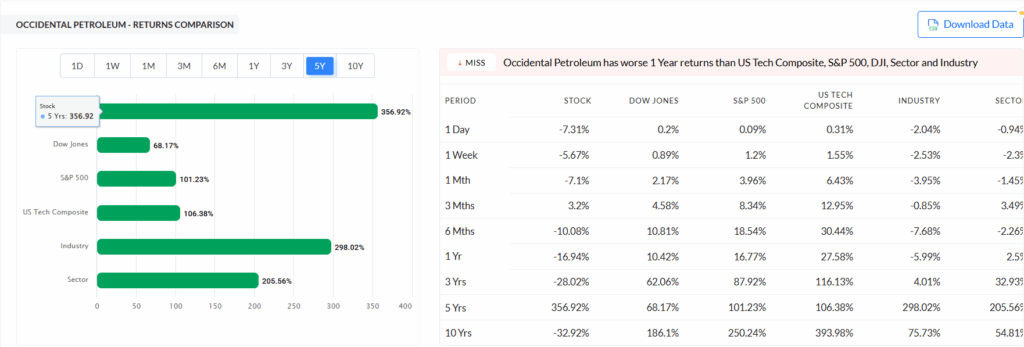

Lately, I’ve been spending some time digging into potential new stocks for my portfolio, and one name that keeps popping up is Occidental Petroleum (OXY). Honestly, it wasn’t a company that was on my radar at first. When I looked at the chart, the performance didn’t exactly impress me. The stock has been pretty rough in recent years, weighed down by debt and all the usual ups and downs that come with the oil and gas industry.

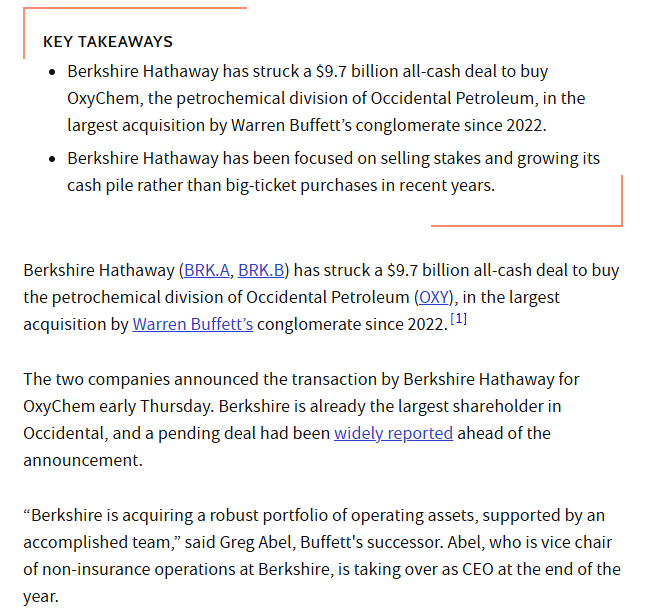

But then I noticed something that made me pause—Berkshire Hathaway (yes, Warren Buffett’s company) has been quietly building up a massive position in Occidental. In fact, they already own a big chunk of it and even have approval to buy up to half of the company. That made me curious.

I started asking myself: What does Buffett see in this stock that I might be missing? He’s not known for chasing hype or jumping into shaky companies without a plan. Usually, when Berkshire takes such a large interest, it’s because they believe there’s serious long-term value hiding behind the noise.

As I read more, a few things stood out to me:

- The world still needs oil and gas, even as renewables grow. That demand isn’t going to disappear overnight.

- Occidental is positioned to benefit if energy markets strengthen or if they manage to strike a big deal that reshapes their balance sheet.

- Having Berkshire as a major backer could give investors more confidence and maybe even stabilize the company.

Of course, I’m not blind to the risks. Energy is a tough, unpredictable sector, and Occidental’s debt load is no small concern. But I can’t help thinking that this could be one of those “rough around the edges” stocks that transforms if the right pieces fall into place.

I haven’t pulled the trigger yet, but it’s on my watchlist. For me, the interesting part of investing is following those little trails of curiosity—spotting when a giant like Berkshire is making a big move and then digging deeper to see if it’s something worth riding along with.

Have you ever invested in a stock mostly because you noticed a big player taking a position? That’s kind of where I’m at with OXY right now.