Intro

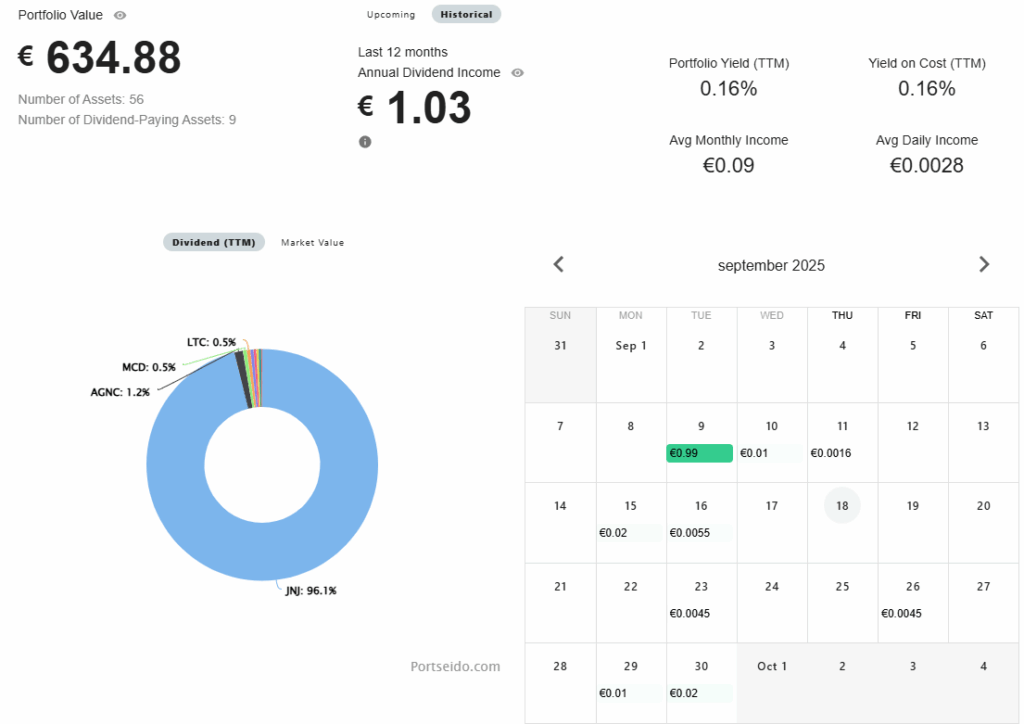

Two weeks into my dividend journey, I finally received my first dividends! The amount wasn’t huge—less than what I might spend on a coffee—but the feeling was incredible. It was my first taste of passive income, and it motivated me to keep going.

In this post, I’ll share what I invested in, why I chose Realty Income (O), and how I manage my dividend portfolio to keep growing over time.

My First Dividends

Receiving that very first dividend felt different from a regular paycheck. Instead of trading hours for money, my money was now working for me.

Even though the payout was small, it symbolized the power of consistency and the potential of long-term investing. Keeping track of these small wins has already made me more excited about building passive income.

Tip: Document every dividend you receive, no matter how small. It’s motivating and helps you track your progress.

Why I Added Realty Income (O)

I recently decided to add Realty Income (O) to my portfolio. Here’s why:

- Reliable monthly dividends: Realty Income has a long track record of paying consistent monthly dividends.

- Long-term growth potential: It’s a stable REIT with a focus on commercial real estate.

- Fits my strategy: I want to build a portfolio that generates steady passive income over time.

I added some extra money this month and split it across my portfolio, including Realty Income, to diversify and strengthen my dividend stream.

Lessons Learned / Key Takeaways

- Small steps matter: Even tiny dividends are motivating and prove your money can work for you.

- Diversify your portfolio: Spreading investments reduces risk and builds stability.

- Track everything: Logging dividends and investments keeps you organized and lets you share your journey with others.

Bonus Resources / Further Learning

Here are a few books that have helped me understand investing and passive income strategies:

- Rich Dad Poor Dad

- Investing for Dummies

- The Intelligent Investor

Also, check out my previous blog:

Conclusion

Receiving my first dividends was just the beginning. I’m excited to continue sharing my journey, lessons, and updates along the way.

Follow my blog and YouTube channel to stay up-to-date on my portfolio, dividend growth, and passive income experiments.